A Comprehensive Summary of Secured Credit Card Singapore Options for Enhanced Credit Report Control

A Comprehensive Summary of Secured Credit Card Singapore Options for Enhanced Credit Report Control

Blog Article

Introducing the Opportunity: Can People Released From Personal Bankruptcy Acquire Debt Cards?

Comprehending the Effect of Insolvency

Upon filing for insolvency, individuals are confronted with the substantial repercussions that permeate numerous aspects of their financial lives. Bankruptcy can have a profound influence on one's credit history, making it testing to accessibility credit score or car loans in the future. This financial stain can linger on credit records for several years, influencing the person's capacity to safeguard favorable rate of interest or financial possibilities. In addition, insolvency might cause the loss of possessions, as specific possessions might need to be sold off to settle lenders. The emotional toll of insolvency must not be ignored, as people may experience sensations of shame, anxiety, and guilt due to their economic situation.

Additionally, insolvency can restrict employment possibility, as some employers perform credit scores checks as component of the working with process. This can position an obstacle to people seeking brand-new task potential customers or occupation developments. Generally, the effect of personal bankruptcy extends beyond monetary restraints, influencing various elements of an individual's life.

Factors Influencing Charge Card Approval

Adhering to bankruptcy, individuals commonly have a reduced credit report rating due to the adverse impact of the bankruptcy filing. Credit card companies normally look for a credit score that shows the applicant's ability to take care of credit score properly. By carefully considering these elements and taking actions to reconstruct credit scores post-bankruptcy, people can improve their potential customers of getting a credit score card and functioning in the direction of financial recuperation.

Actions to Restore Credit After Bankruptcy

Rebuilding credit scores after bankruptcy requires a tactical technique concentrated on monetary discipline and consistent financial obligation monitoring. The primary step is to examine your credit scores report to make certain all financial obligations included in the bankruptcy are properly shown. It is vital to develop a budget plan that focuses on debt repayment and living within your ways. One effective method is to obtain a safe bank card, where you transfer a specific quantity as collateral to establish a credit line. Prompt repayments on this card can show accountable credit scores use to prospective loan providers. Furthermore, think about becoming an accredited individual on a relative's credit rating card or discovering credit-builder loans to additional enhance your credit report rating. It is important to make all settlements on schedule, as repayment background significantly influences your credit rating. useful content Perseverance and willpower are vital as restoring credit score requires time, but with commitment to appear monetary methods, it is feasible to improve your creditworthiness post-bankruptcy.

Protected Vs. Unsecured Credit Scores Cards

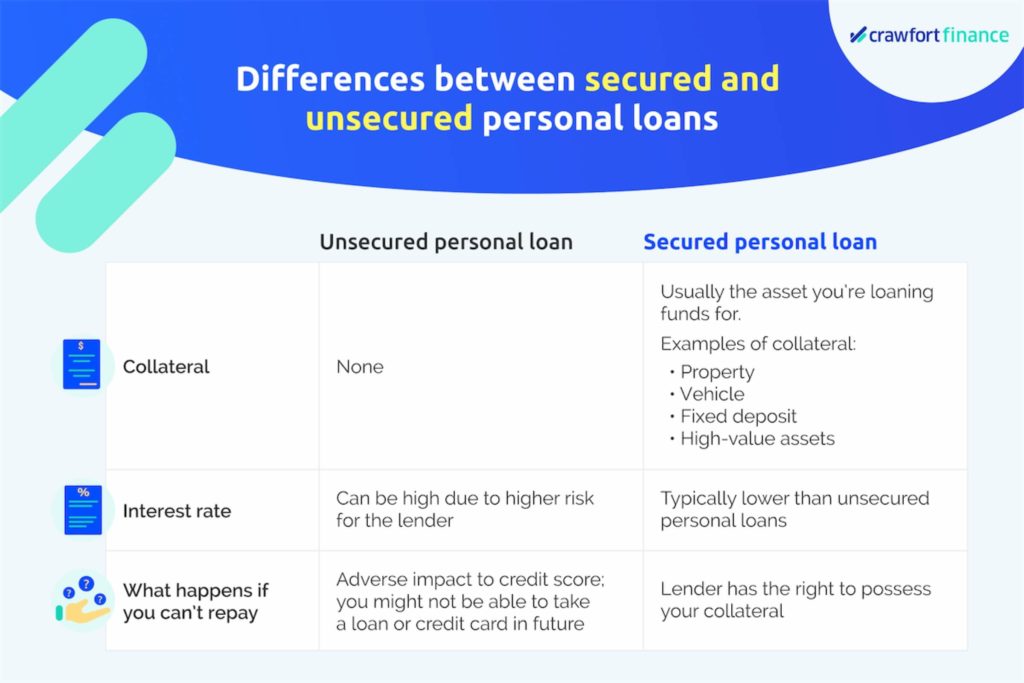

Following personal bankruptcy, individuals commonly consider the choice between safeguarded and unsafe credit scores cards as they intend to rebuild their credit reliability and monetary security. Safe credit rating cards need a money deposit that serves as collateral, usually equivalent to the credit rating restriction given. Inevitably, the option between safeguarded and unsafe credit cards should line up with the person's monetary objectives and capability to take care of debt find out here now sensibly.

Resources for Individuals Seeking Credit History Restoring

For people intending to enhance their creditworthiness post-bankruptcy, discovering readily available resources is critical to successfully browsing the debt rebuilding procedure. secured credit card singapore. One important source for people seeking credit report rebuilding is credit history therapy companies. These organizations offer economic education and learning, budgeting help, and personalized credit report renovation strategies. By collaborating with a credit counselor, individuals can acquire insights into their credit rating reports, find out strategies to boost their credit history, and get support on managing their financial resources successfully.

An additional helpful source is credit report monitoring services. These solutions permit individuals to keep a close eye on their debt records, track any kind of inaccuracies or changes, and find prospective indications of identity theft. By checking their credit rating on a regular basis, individuals can proactively address any type of issues that may occur and guarantee that their credit history details depends on date and precise.

Furthermore, online devices and resources such as credit rating simulators, budgeting apps, and economic literacy sites can provide individuals with valuable information and tools to help them in their credit report reconstructing journey. secured credit card singapore. By leveraging these resources effectively, people discharged from bankruptcy can take meaningful actions in the direction of improving their credit history wellness and securing a much better monetary future

Conclusion

In verdict, people released from bankruptcy may have the possibility to get bank card by taking steps to reconstruct their credit rating. Variables such as credit score background, revenue, and debt-to-income proportion play a considerable function in bank card approval. By recognizing the effect of insolvency, selecting in between safeguarded and unsecured charge card, and utilizing resources for credit history rebuilding, people can enhance their creditworthiness and possibly acquire accessibility to credit report cards.

By functioning with my sources a credit scores counselor, people can gain insights right into their credit records, learn methods to enhance their debt ratings, and obtain support on managing their funds effectively. - secured credit card singapore

Report this page